Żabka: a story of continuous search for convenience

Uncovering the business model and prospects of the business.

Introduction

Investing in convenience

Is Poland saturated?

Quick look at international expansion

Growth levers

Closing

1. Introduction

Żabka has become synonymous with convenience in Poland, even for those who have only briefly visited the country. Its cultural influence is evident in the many internet "pastas".

Żabka's journey began in 1998 in Poznań, Poland, where it started as a small chain of local convenience stores. The company's founders recognized the need for easily accessible, quick-shopping options to serve the needs of busy consumers.

Key milestones in Żabka's growth include the introduction of its franchise model, which allowed for rapid expansion while maintaining quality control. By 2010, the company had reached 2,000 stores, demonstrating the effectiveness of this approach.

Ownership of Żabka has changed hands several times, reflecting its growing value and potential. In 2007, Czech investment firm Penta Investments acquired the company. Later, in 2017, CVC Capital Partners, a major private equity firm, purchased Żabka, signaling confidence in its future prospects.

Żabka's IPO marked a new chapter, listing it as one of the largest companies on the Polish stock exchange.

In this article, I will explore Żabka's business model, valuation, and prospects.

2. Investing in convenience

The evolving relationship between free time, convenience, and food preparation presents a multi-trillion dollar global market opportunity, with significant implications for businesses like Żabka. While free time has steadily increased over centuries, a trend accelerated by AI-driven service automation, the future of food consumption remains a subject of debate.

One perspective suggests that as free time expands, cooking may become a form of self-care, a mindful activity offering respite from increasingly digital lives. Conversely, another view posits that with more compelling leisure options like travel, entertainment, and social dining experiences, cooking will become less appealing. I believe the latter scenario is more likely, with the majority of caloric needs being met by external sources, such as restaurants (dine-in and delivery) and catering services.

This shift towards external food providers presents a significant opportunity. However, certain trends pose challenges for convenience-focused businesses like Żabka. These include the declining consumption of alcohol (in volume) and the growing preference for less processed foods. Navigating these trends will be crucial for success in this dynamic market.

Żabka is well-positioned to capitalize on these evolving trends, with exposure across nearly all relevant areas, except perhaps direct food delivery. Furthermore, shifts in cost structures, particularly a decrease in rent relative to labor, could significantly benefit companies heavily invested in automation, while potentially rendering labor-intensive businesses obsolete.

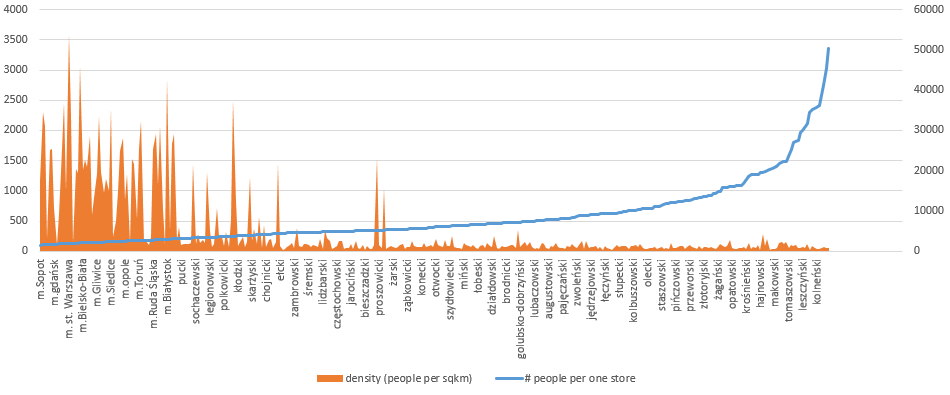

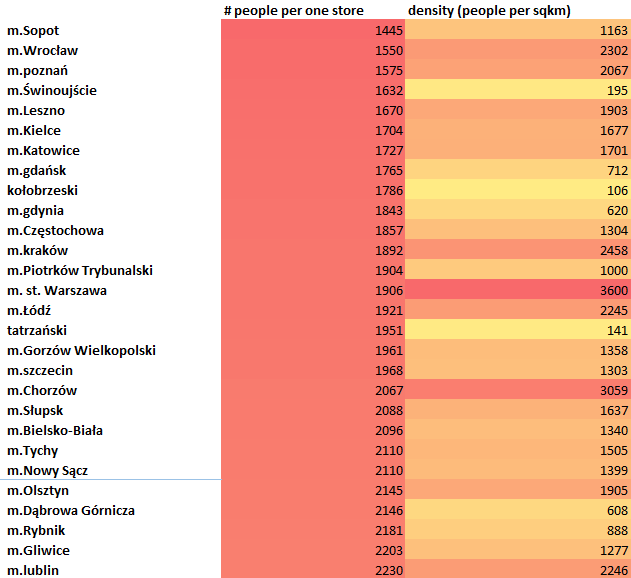

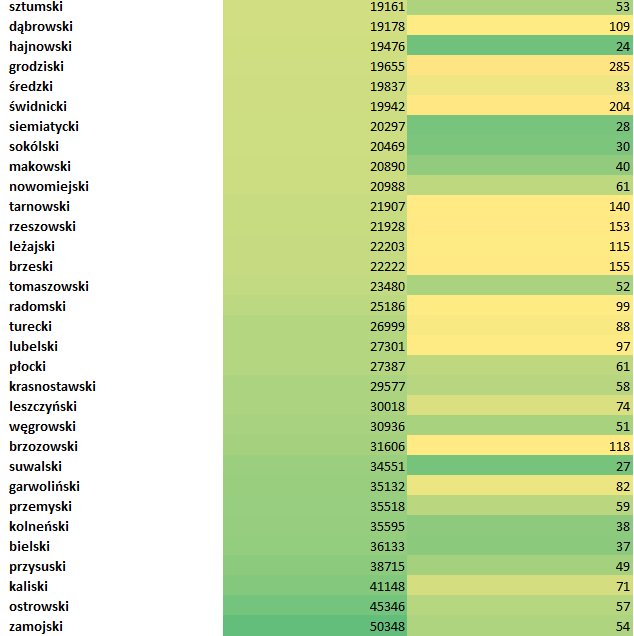

3. Polish saturation?

Żabka's growth potential in Poland is often questioned, with saturation concerns frequently raised. Determining the optimal store density, the maximal population-per-store ratio and achievable EBITDA per store requires considering four key factors:

Foot Traffic: Primarily driven by population density (not linear) and free time, though exceptions exist (as demonstrated below).

Cost of Time vs. COGS & Labor: The balance between customers' perceived "cost of time" and Żabka's COGS and labor costs per item sold is crucial.

Service and Product Breadth: The range of offerings provided by Żabka significantly impacts its appeal.

Free Time Preferences: Cultural factors, such as cooking habits and entertainment choices, influence consumer behavior.

Żabka can directly influence the first three factors. However, free time preferences are culturally driven and largely beyond Żabka's direct control.

Below more detailed table of chosen locations (defined here as “powiat” lub miasto).

I think there's still room for Żabka to expand in Poland, though some new store formats and product/service offerings may be necessary.

The data, gathered via web scraping of open data (with thanks to Michal Faron), may contain some abnormalities due to the source.

4. Quick look at international expansion

Żabka's expansion strategy began in Bucharest, Romania, a market similar to Poland in terms of cultural preferences and history. Bucharest also boasts a higher population density than Warsaw and a greater share of the national population, making it a logical first step.

While details about the expansion strategy remain limited (and I really hope that it changes), it's crucial to understand the core strengths of Żabka's business model. These strengths lie in data-driven decision-making for assortment, location selection, and technological comparative advantages. Therefore, when expanding globally, Żabka should prioritize organic growth of franchisees coupled with potential acquisition of the backend (warehouses, logistics) in countries where they expand to. Acquiring local brands significantly increases complexity but can provide a higher margin and a more vertical approach. Acquiring existing convenience chains is the worst solution due to format differences and potentially unoptimized locations. Also, in acquisition, it is sometimes hard to attribute the success factors correctly which makes it harder to scale (in this particular model).

Considering Allegro's unsuccessful acquisition strategy (bought 1P marketplaces while operating 3P), Żabka should prioritize maintaining a consistent, unified brand identity across the entire group (only differ on product levels). The marketing of the Żabka concept should maintain a consistent brand identity regardless of geographical location as the integration of Europe progresses.

Regarding international expansion and countries to choose from, Żabka should focus on two of the previously mentioned factors: "Cost of Time vs. COGS & Labor" and "Free Time Preferences," as well as the practicalities of market entry, such as market concentration and the availability of “backend” acquisition opportunities.

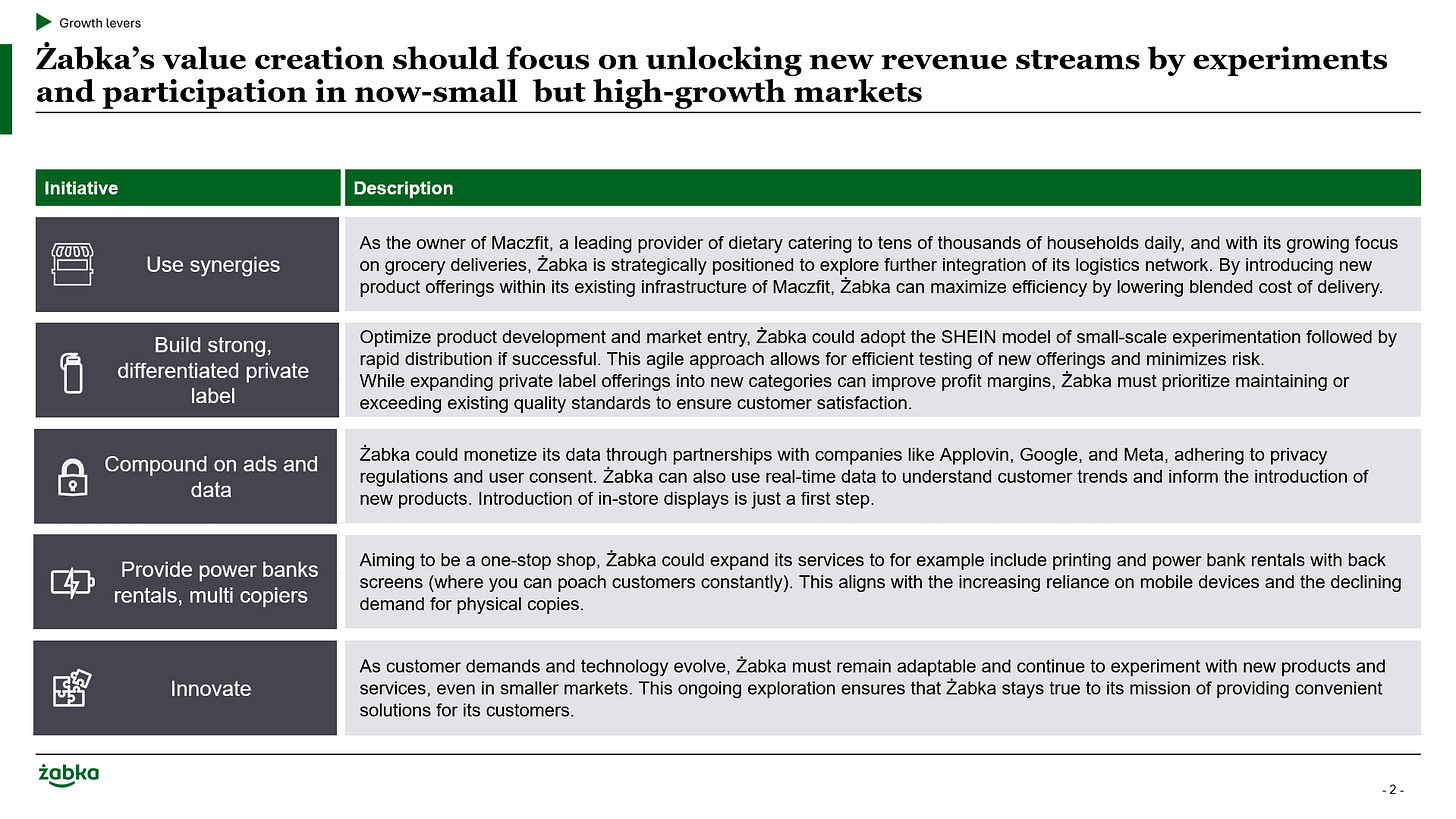

5. Growth levers

Żabka faces several key opportunities and challenges.

Infrastructure Synergies - Żabka's infrastructure synergy with Maczfit appears underutilized. Żabka should leverage its infrastructure as a “backend”, with frontend solutions developed by franchisees (small store innovations) and internal product teams (Żabka Jush, Dietly). (The question of lower margins for Maczfit catering within Żabka vs substitutes like hotdogs)

Private Labels - Expanding private labels and further vertical integration offer opportunities to increase margins.

Data Advantage - Żabka's data represents a potential competitive edge that needs to be fully exploited.

Challenges of OPEX reduction

Increasing pressure on OPEX (for both Żabka and franchisees) necessitates a focus on automation (warehouses and stores). However, automation can be complex and costly. Żabka Nano serves as a valuable testbed, but its challenges need to be addressed.

Żabka Nano struggles with its inability to sell high-margin items (alcohol, cigarettes, hot food). Inventory management and maintenance are also less efficient than traditional stores. This has hindered scaling.

Żabka Nano and dietary catering represent an "Innovator's Dilemma," where Żabka may be scared to introduce lower-margin products as they will cannibalize those with higher margins but grow the nominal value.

Navigating these growth levers and structural challenges will be crucial for Żabka's future.

5. Closing

Żabka's success story is a testament to the effective execution of Value Creation Plans driven by its private equity sponsors. However, the story is far from over. With continued effective execution, multiplying value is within reach. Analysts suggest market saturation in Poland may be overlooking the growth prospects. The best companies create and grow their markets. Consider the evolution of the 'convenience' market. Before Żabka's arrival, it was significantly smaller. Similar opportunities may exist in other European countries where the "convenience" market remains underdeveloped due to historical factors, consumer habits, and the absence of a company with Żabka's relentless drive.

This potential for international expansion, coupled with continued growth opportunities in Poland and expansion into emerging verticals, creates powerful tailwinds. Harnessing these tailwinds effectively can generate substantial additional value for shareholders. Valuation of the company also seems attractive, especially for large investors and considering comparables (long Żabka/ short Dino :)).

You can follow and subscribe for free here and on X. ← LINK

Slides template by: